Betting The Farm On The Right Curve

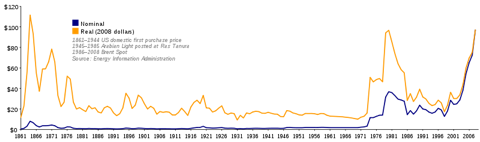

I’m going to show you the prices of three energy sources (e.g. oil or wind or coal in say, dollars per barrel) over time. (For you geeks, these are all in 2008 $ and the source is the U.S. Dept. of Energy)

US taxpayers have subsidized one of these energy sources for nearly a century with tens of billions of $ of tax breaks and other easements every year. As a result, we now depend upon this source of energy above all others.

You as President, must decide which energy sources you support and which you think the United States should wean itself away from.

From the mystery charts below, pick the two energy sources you think would be best for the American people and click Read More to find out what they are...

1.

2.

3.

Read More...

Read More...If You Read Just One Book This Year...

This book should be required reading for everyone in the developed world. That’s a strong statement and I’ll preface it with the fact that I often find that three-times Pulitzer Prize winner Thomas Friedman’s New York Times writings sensationalist.

Hot, Flat & Crowded, (winner of Washington Post, Chicago Tribune & Business Week Book of the Year) is different. It’s visionary, well researched and page-turningly well written. It offers a new path away from the growing consequences of our increasingly hot (climate change), flat (rapidly expanding global middle class), and crowded planet.

To begin with, the book demonstrates there is simply not enough energy to fuel a 10x growth of the world’s consumptive middle class driven by China & India if this middle class consumes as much resources (energy, water, land) as we do today. If you buy this thesis (and it’s hard not to, based on the evidence we saw in the summer of 2008 with skyrocketing commodity prices, record pollution and temperatures) the question Friedman begs is: now what?

Here is the visionary part: Friedman creates a wholistic (and fact-based) perspective of how an resource-efficient, economic, clean and sustainable low/no carbon economy can be built with existing and maturing technologies. And it offers a path to return the United States to the forefront of its historical leadership: exporting new technologies - something we have lost in the past 15 years.

If this all sounds horrendously dull, it’s not. The inspired vision is matched by inspired writing. Get it here. To save some paper and energy, read it on your Kindle 2 or get it from your library.

REALLY fixing Detroit

Taxpayers have pumped over $20B into Detroit with more to com - yet it is a band aid, not a fix. To be sure, Detroit and its unions have been their own worst enemies but government regulation is a close second. Deregulation and synchronization with global standards are the key to the survival of the US auto industry. Here’s what needs to change to ensure economic viability AND environmental sustainability of this industry. Read More...

Taxpayers have pumped over $20B into Detroit with more to com - yet it is a band aid, not a fix. To be sure, Detroit and its unions have been their own worst enemies but government regulation is a close second. Deregulation and synchronization with global standards are the key to the survival of the US auto industry. Here’s what needs to change to ensure economic viability AND environmental sustainability of this industry. Read More...HCR-188c The Holy Grail Of Refrigerants?

What if a refrigerant...

- Reduced refrigerator and A/C energy consumption by over 30%

- Cost just 1/3rd of conventional refrigerants

- Has 96% less global warming impact than conventional refrigerants

- Has zero ozone depleting impact

What if this breakthrough was not developed by a giant chemical company, but over the past 15 years by a passionate former mechanic in Hawai’i?

Mr. Maruya of Kane’ohe Hawai’i could be one of this century’s energy heroes.

The EPA has just approved Mr. Richard Maruya’s remarkably simple HCR-188c refrigerant. Haier the Chinese white goods giant has provided research assitance, while Greenpeace has given him recognition.

While we would love to see the world beat a path to Mr. Maruya’s door, his challenge may be just beginning...Read More...

Russian Oil: Heads I Win, Tails You Lose

High oil prices earned Russia the tax revenue to renationalize its oil companies as oil prices fell.

High oil prices served Russia well - financing a military buildup and allowing it to build big cash reserves from tax revenues. But now prices are low, Mr. Putin is using its cash to renationlize the oil companies (along with steel, iron and other firms) in another dangerous step towards rebuilding the Soviet Union. His next step?Read More...

China Ends Fuel Subsidies - Will Others Follow?

China, the world’s #2 oil consumer behind the US, has demonstrated a remarkable show of economic force: it eliminated fuel subsidies and let oil prices float. Better yet, it increased gasoline tax 500% and diesel tax 800% to about $0.14 per liter ($0.50 per gallon.)

OPEC predictably reacted allergically but the real question is will other fuel subsidizing countries like India, Mexico and Indonesia follow? Here’s why they can and should now.Read More...

"$80 to $100 Is A Fair Price For Oil..."

According to our “friend” President Hugo Chavez of Venezuela at today’s press conference with Dmitry Medvedev “President” of Russia: "Let's look for a band between $80 and $100; we're thinking about that," Chavez said Monday. "We think that price would be a fair price for oil." Venezuela & Russia are seeking OPEC production cuts...

According to our “friend” President Hugo Chavez of Venezuela at today’s press conference with Dmitry Medvedev “President” of Russia: "Let's look for a band between $80 and $100; we're thinking about that," Chavez said Monday. "We think that price would be a fair price for oil." Venezuela & Russia are seeking OPEC production cuts...Read More...

$135 Oil: Over our own barrels...

California, and subsequently the U.S. banned offshore oil drilling in 1970 after a well blowout off Santa Barbara in 1969 created a major oil spill. Forty years later, offshore oil production is clean and safe in far more challenging waters like the North Sea off Norway and far offshore in Brasil. Read More...

Of gas tax holidays...

This is wrong for several reasons - here’s why, and here’s how to save on gas anyway...Read More...

Send a Message to Congress: Do The Right Thing

Alaskan Field failure demonstrates US energy security problems

Use Half.Read More...

The first true biofuels company

The large amounts of highly productive land, world-leading crop-growing technology and Hawaii's year-round sunny climate & rich soil make Hawaii BioEnergy the first potentially economical and sustainable biofuels company in the United States. Unlike corn-based biofuels, Hawaii BioEnergy's focus is on true positive net energy balance fuels.

Watch this space. Hawaii BioEnergy has the potential be the IBM PC (or perhaps we should say AOL) of biofuels companies.